nassau county tax grievance form

Click Here to Apply for Nassau Tax Grievance. 100s of Top Rated Local Professionals Waiting to Help You Today.

Platinum Tax Grievances Home Facebook

Click Here to Apply for Nassau Tax Grievance.

. 631 302-1940 Nassau County. Instructions For TP584 PDF TP584 Form PDF Fill In TP5841 Form Instructions For IT2663 PDF 2021. Click this link if you prefer to print out the application in PDF form and fax it to.

New York Tax Forms page. If you cannot find the answer to your question on any of the pages referred to above or have any comments concerns or helpful suggestions about this site please fill in the contact form below or contact us at. Does a finished basement raise your taxes.

For example the deadline to file a 20232024 tax grievance is May 2 2022. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. Submitting an online application is the easiest and fastest way.

ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your. These are the official forms for use in Nassau County Court proceedings. Click Here to Apply for Nassau Tax Grievance.

Nassau County Property Tax Grievance Bohemia NY Submit a Property Tax Grievance Form for Nassau County DESIGNATION OF REPRESENTATIVE AND AUTHORIZATION I hereby retain Lighthouse Tax Grievers Corp. It would be our pleasure to assist you. The form can be completed by yourself or your representative or attorney.

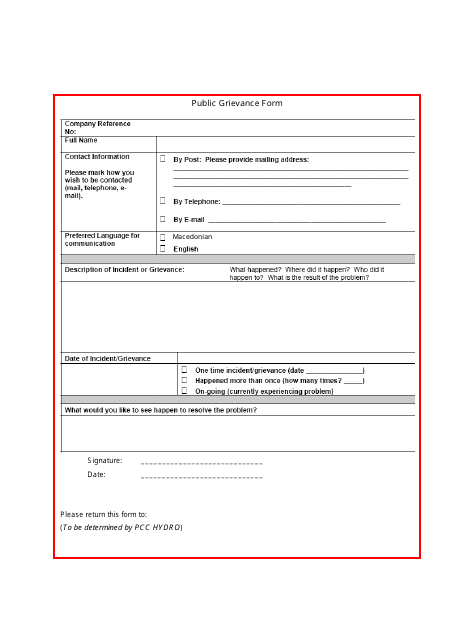

Should you grieve your taxes every year. Proposed Short Form Commission for Art. File the grievance form with the assessor or the board of assessment review BAR in your city or town.

Nassau County Tax Grievance Form. How do I grieve my Nassau County taxes. File the grievance form with the assessor or the board of assessment review BAR in your city or town.

The form can be completed by yourself or your representative or attorney. The form can be completed by yourself or your representative or attorney. Legislator Kevan Abrahams Presents Free Tax Grievance Workshops Jan 25th 2022 12PM-2PM Jan 27th 2022 Thursday 12PM-2PM and Feb 17th 2022 Thursday 7PM-9PM.

Submitting an online application is the easiest and fastest way. Ways to Apply for Tax Grievance in Nassau County. NO REDUCTION NO FEE Please sign and complete below Mail OR Fax to 631-486-7792.

Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. 81 Guardianship proceedings PDF. Completing the grievance form Properties outside New York City and Nassau County.

Or you can call us at 516-342-4849. This website will show you how to file a property tax grievance for you home for FREE. RP-523-Dcl Fill-in Instructions on form.

516 342-4849 email protected. Click this link if you prefer to print out the application in PDF form and fax it to 631-782-3174. RP-524 Fill-in RP-524-Ins Instructions.

ARCs services for homeowners commercial taxpayers and tax. NASSAU COUNTY PROPERTY TAX GRIEVANCE FORM DEADLINEMARCH 1 2021 Its simple and f ast and ou r experienced s taff will take care of the entire process. Town of Hempstead Receiver of Taxes.

For Tax Class and Exemption Claims pdf file Instruction for form AR3. THERE IS ABSOLUTELY NO FEE TO YOU unless we do. The form can be completed by yourself or your representative or attorney.

File the grievance form with the assessor or the board of assessment review BAR in your city or town. Ad 2009 DPF-251 More Fillable Forms Register and Subscribe Now. Filing the grievance form Properties outside New York City and Nassau County Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

Click this link if you prefer to print out the application in PDF form and fax it to. Ways to Apply for Tax Grievance in Nassau County. For a 1 2 or 3 Family House pdf file Instruction for form AR1.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. NASSAU COUNTY PROPERTY TAX GRIEVANCE FORM. Between January 3 2022 and March 1 2022 you may appeal online.

You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. Town of North Hempstead. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022 The Assessment Review Commission - ARC - acts on appeals of county property assessments.

Filing the grievance form Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. Yes it will since the overall value of your property also increases when you finish your basement.

Nassau County Tax Reduction Application. Ways to Apply for Tax Grievance in Nassau County. We offer this site as a free self help resource for people like you that want to.

However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. Nassau County Legislature District 1 - Kevan Abrahams. Hereinafter referred to as LHTG as my sole agent to file a grievance against the 20212022 tax roll.

File the grievance form with the assessor or the board of assessment review BAR in your city or town. Property tax forms - Assessment grievance. We will get you the REDUCTION YOU DESERVE.

Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is approximately 18 months in advance of the tax year being challenged barring any extensions. Notice of Disclosure of Interest of Board of Assessment Review Member in Parcel for Which Assessment Complaint Has Been Filed. For Other types Property pdf file Instruction for form AR2.

File the grievance form with the assessor or the board of assessment review BAR in your city or town. Ad Download Or Email Form RP-524 More Fillable Forms Register and Subscribe Now. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

Submitting an online application is the easiest and fastest way. At the request of Nassau County Executive Bruce A. Filing the grievance form The form can be completed by yourself or your representative or attorney.

Other municipal offices include. Table Of Contents Nassau County. Rocky Point Office Corporate 333 Route 25A Suite 120 Rocky Point NY 11778 Suffolk County.

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Nc Property Tax Grievance E File Tutorial Youtube

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Make Sure That Nassau County S Data On Your Property Agrees With Reality

District 3 Carrie Solages Nassau County Ny Official Website

5 Myths Of The Nassau County Property Tax Grievance Process

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Tax Grievance Form Form Ead Faveni Edu Br

Tax Grievance Form Form Ead Faveni Edu Br

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island