crypto tax calculator australia

The Crypto Tax Calculator software is designed to meet ATO guidelines so you wont have to go through all the trouble of downloading other tax apps available in Australia. 29467 plus 37c for each 1 over 120000.

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Using The Australian Cryptocurrency Tax Calculator.

. Ethereum Solana and more. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Our subscription pricing is per year not tax year so with an annual subscription you can calculate your crypto taxes as far back as 2013.

This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements. Sort out your crypto tax nightmare. You can import data for.

51667 plus 45c for each 1 over 180000. If you sell or swap your cryptocurrency. Your crypto gains are to be included in your.

The process is the same just upload your transaction. Dont have an account. AU Tax season is here.

The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset. June 27 2022. Get your crypto tax done today.

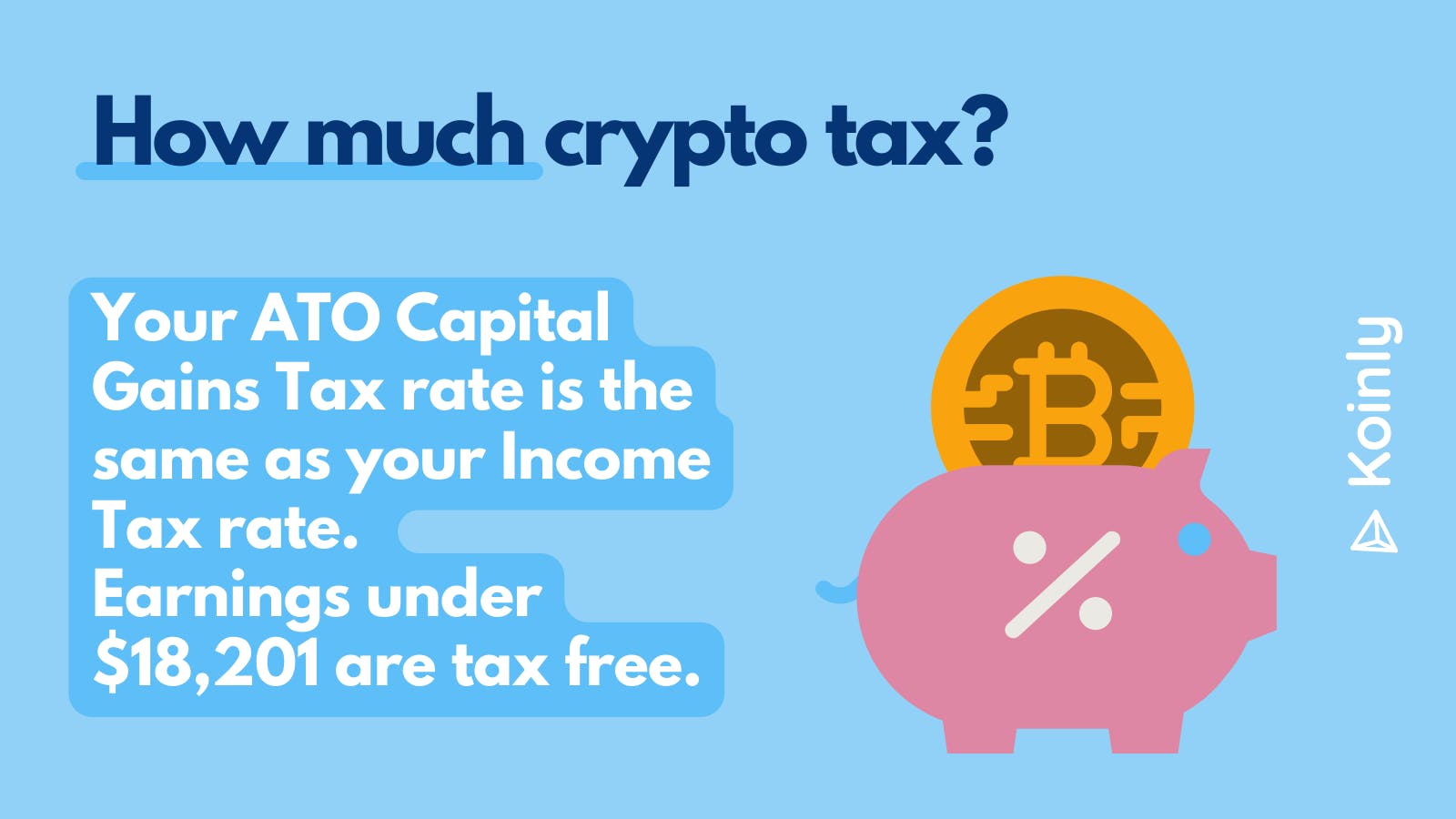

The CoinTracking tax calculator for Aussies. Supports DeFi NFTs and decentralized exchanges. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales.

Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Koinly Crypto Tax Calculator For Australia Nz from imagesprismicio Enter your ethereum wallet and coinledger will automatically calculate taxes on your nft and. At Crypto Tax Calculator Australia their state of the art application makes calculating cryptocurrency tax easy whether you are a beginner trader or a crypto trading master.

Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years. Simply import your cryptocurrency data in form of a CSV file and. To get a more accurate reading and find out what your final capital gains tax will look like call 13 23 25 and let our tax agents.

Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. CryptoTax Calculator is another great option for Australians who want to automate their crypto tax. Please be mindful that our tax calculations are only estimates.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax In Australia The Definitive 2022 Guide

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Cryptocurrency How To Become Rich

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Bitcoin Price Prediction Today Usd Authentic For 2025

How Two Brothers Started A 3 5k Month Side Hustle Sells Custom Maps Starter Story Custom Map Successful Business Owner Custom

Crypto Tax In Australia The Definitive 2022 Guide

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly